What to know about Oanda

Oanda has been dominating the forex market for the last 27 years. The company started based on the belief that technology and the internet would transform the world into one global market, and they were right about that. Today, the internet has created a vacuum for currency-related products and services, and Oanda, well poised for the market, is steadily meeting the ever-growing demands of the forex market.

When the company was founded in 1996, they were the first brokers to offer free information about an extensive range of currency exchange rates over the web. Oanda became an internet-based business-to-business (B2B) application service provider the following year. Now, that service has grown in Oanda, providing application service to over 75,000 clients and handling millions of queries worldwide.

Oanda maintained the Application Service Provider (ASP) market for a while. Then, in 2001, they expanded, adding fxTrade to their services, making them one of the very first companies in the US to offer fully automated online currency trading. With the automated system, traders can run algorithms or trading strategies. With Oanda’s fxTrade system, customers can access a state-of-the-art platform that gives institutional and retail clients a competitive edge in the foreign exchange market. This is not just because of their range of commercial instruments but also because of the advanced charting tools, user-friendly interface, and competitive spreads.

Why trade forex with Oanda?

Oanda has built for itself a reputation that is based on transparency, reliability, a customer-focused approach, and a pricing model that is strikingly different from that of its competitors. The following is a breakdown of what makes Oanda unique and why you should trade forex with them:

- Licensed and regulated by the appropriate bodies in six countries: Where some brokers are licensed in two or three countries, Oanda stands differently, being registered in six. These countries include the US, UK, Canada, Australia, Japan and Singapore.

- Accept clients from the US: Oanda is one of the few global online forex brokers that allow US clients to trade on their platform. Oanda being regulated in the US, adds to its credibility and trustworthiness.

- They have extensive forex educational materials: In a market that is constantly changing, like forex, there is always something new to learn, unlearn, and relearn. Whether you are a beginner, intermediate, or expert trader, Oanda provides all the resources you need to improve, from articles to trade tutorial videos.

- Oanda’s investment offerings: Depending on the entities regulating your account, Oanda has various investment options for you to choose from, including 71 forex pairs.

What forex pairs does Oanda offer?

Forex pairs are major currency combinations available to traders. Oanda offers over 68 currency pairs, making it easier for traders to trade emerging markets and major, minor, and exotic pairs with a competitive spread. Here is a table showing Oanda’s seven major forex pairs.

Types of major forex pairs

| Forex Pair | Currencies in the pair |

| EUR/USD | Euro / US Dollar |

| GBP/USD | British Pound / US Dollar |

| USD/JPY | US Dollar / Japanese Yen |

| AUD/USD | Australian Dollar / US Dollar |

| USD/CHF | US Dollar / Swiss Franc |

| USD/CAD | US dollar / Swiss Franc |

| NZD/USD | New Zealand Dollar / US Dollar |

Of these seven pairs, there are the traditional four pairs. These pairs are referred to as traditional because they are the most actively traded pairs in the world.

1. EUR/USD

2. USD/JPY

3. GBP/USD

4. USD/CHF

What are Oanda’s features?

Oanda’s features differentiate it from other forex brokers and give the clients the best trading experience. Here are some of those features:

- Oanda’s operations are regulated: Oanda is regulated by eight recognized bodies -seven Tier-1 regulators, and one Tier-4 regulator.

- Security: Oanda has a firm security background with a two-factor authentication system to protect traders’ accounts and funds from unauthorized access.

- Forex education: Oanda allows its traders to learn everything about the forex market through various means, like live seminars and a dedicated YouTube channel.

- Demo accounts: With Oanda, you can test the waters; you don’t have to plunge into the market before you feel adequately equipped. The Oanda demo account allows you to put all you know and understand the forex market into practice before you enter the big leagues.

- Deposits and withdrawals: Oanda accepts deposits and supports withdrawals via credit cards, bank wire and transfers, and several e-wallet applications like Skrill and Neteller.

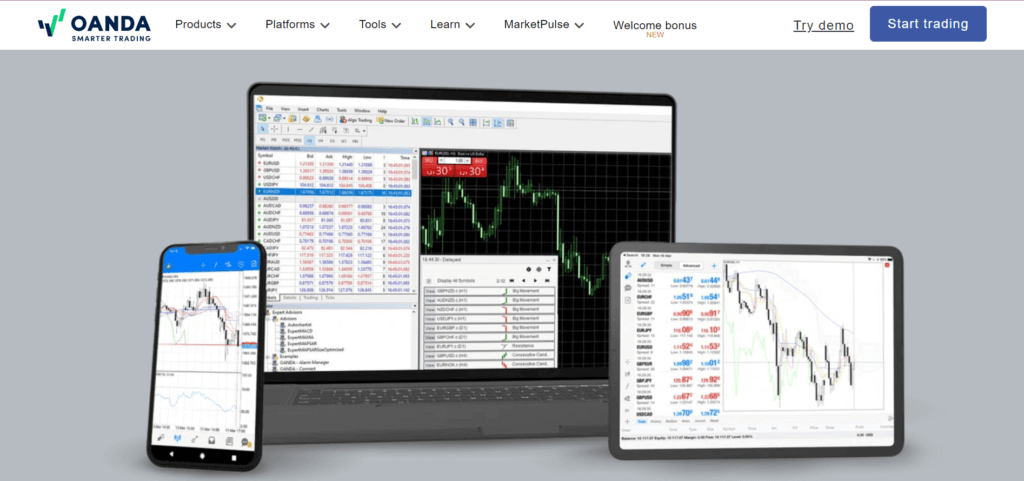

- Oanda has three trading platforms: The fxTrade, which is a proprietary platform, and integrates the MetaTrader 4 and MetaTrader 5 platforms. They all have different features, making them unique. All three platforms are available as mobile and desktop applications.

- Commissions and fees: There is a fixed commission for each trade made, and the total cost of each trade will be the sum of the core spread plus the commission, which is $50 per 1M.

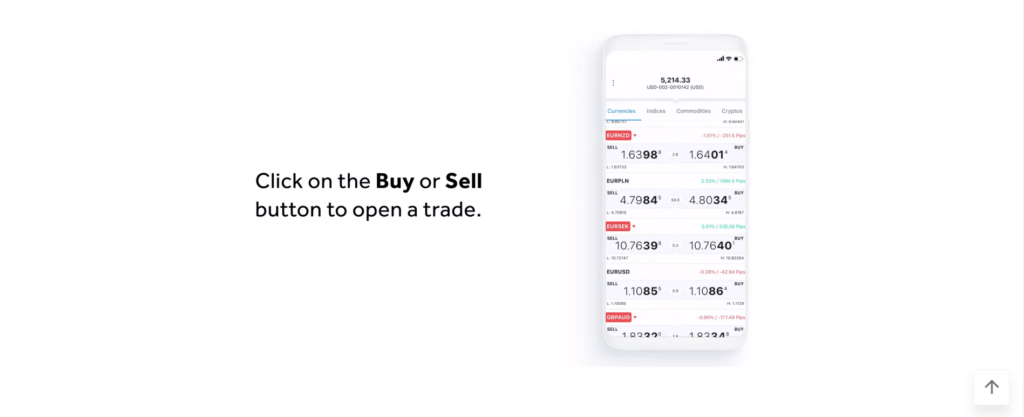

- Oanda is available on mobile: You can trade anywhere, anytime, with Oanda’s mobile app version. The app is easy and straightforward, so you can set up a trade or price alert whenever you want to play. The app also includes news headlines and Autochartist (an automated financial market analysis service) to keep traders informed.

- Economic calendar: Oanda offers its traders a comprehensive economic calendar that allows you to track the significant events and the impact they could have on the market. This way, traders make informed decisions on the strategies to implement in their trade.

- Customer support: Oanda’s customer support is top-tier. The broker has an active team 24/5 to provide help via email, live chat, and direct phone lines. There is also an FAQ section on the website where you can find answers to common queries and helpful resources.

What are the pros and cons of Oanda?

Like everything in the forex exchange market, Oanda has its pros and cons, and properly weighing both sides of the coin will help determine if Oanda is the best broker for you. So, here are the pros and cons of trading with Oanda:

| Pros | Cons |

| Accepts US clients | No protection for US clients. A negative account balance results in owing the broker. |

| All trading platforms are well-designed | There are no guaranteed stop losses for US or UK clients. |

| Invaluable research materials | Customer support is not available 24/7 |

| Fast, easy, and fully digital account opening | No banking and stock exchange background |

| The first card withdrawal of the month is free | |

| No minimum deposit | |

| Free withdrawals | |

| Two-factor authentication on all accounts | |

| Quality new flow |

How do you open an account with Oanda?

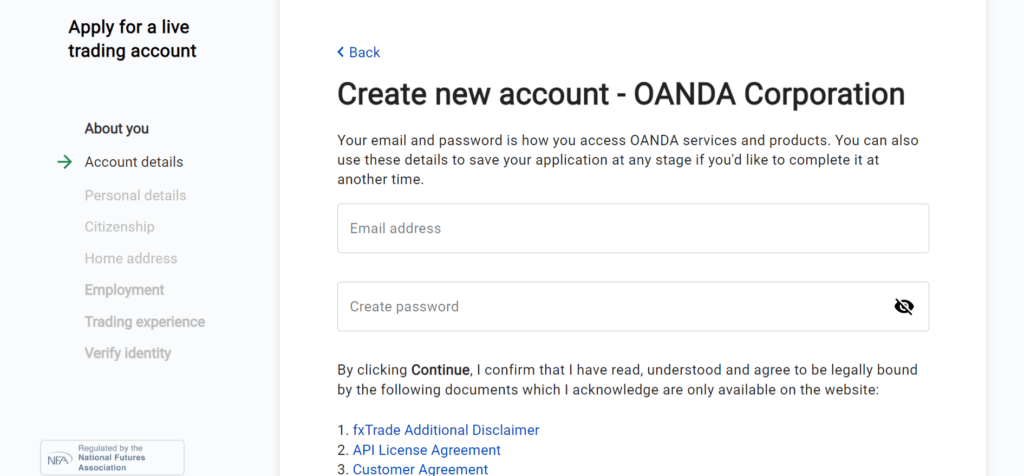

Thanks to their fast and fully digital system, opening an account with Oanda is pretty straightforward. Anyone can open an account with Oanda in minutes, depending on the part of the country they live or are trading from. To open your account, follow these steps:

- Visit Oanda’s website: To open your trading account, visit Oanda’s official website and click on the “Start Trading” or “Create Account” tab at the top right of the screen.

- Select your residence: Oanda needs to know your location, so select your country and state.

- Fill in personal information: This is a one-time process – all you have to do is fill in details like your name, date of birth, e-mail, mobile phone, number, and other details requested. Once done, click on next.

- Confirm nationality: For this step, you will need to upload a valid ID – driver’s license or any other valid means of identification you own.

- Fill in your address.

- Fill in your employment and financial status: Oanda will decide if you can open a forex trading account with them based on this information.

- Cross-check the information you filled out: Make sure all the information in the blanks is correct.

Once these steps have been completed, ensure that your submitted mail address is logged in on your device. In a day or two, Oanda will send a mail to complete your verification process. All you have to do from here is fund your account and start trading.

What are the ratings of Oanda?

Many factors help traders choose the best brokers to work with, and Oanda has been rated based on some key factors. Here are a few of them:

- Minimum deposit: There is no minimum deposit amount and you can deposit up to $9,000. This means that you can deposit as little money as you wish to start trading with Oanda. Rating: 10/10

- Demo account: Oanda offers beginner traders one demo account to practice on till they are confident enough to trade in the real market. The account offers up to $100,000 in virtual funds. Rating: 7/10

- Pricing/Fees: In terms of trading fees and spread Oanda is competitive. Their pricing models are clear and transparent. Rating: 8/10

- Security: Oanda’s security involves a two-factor authentication system on both web and mobile. Rating: 8/10

- Trader education: Oanda provides a variety of educational resources, including courses, webinars, platform tutorials, and research amenities. Rating: 8/10

- Customer support: They are fully available on all communication lines at the stated hours of work (24/5) and offer swift responses. Rating: 9/10

- Beginner-Friendliness: If you are new to forex and looking for a suitable broker, Oanda is a great option. You can trade on a free demo account and have access to the best forex research materials. Rating: 7/10

- Trading Experience: Oanda offers traders a good experience as the brokers’ web and mobile interfaces are user-friendly. Rating: 8/10

- Trading Platform Features: The platform has a wide range of trading platform features, including advanced charting tools, customizable layouts, and order types. Rating: 9/10

- Currency pairs: Oanda offers various selections of currency pairs for trading, allowing traders to enjoy many trading opportunities. Rating: 8/10

How does Oanda compare to other forex brokers?

Being in the forex market for 27 years gives Oanda vast experience, translating to their expertise in foreign exchange and helping traders. One of the things that sets Oanda apart from other brokers is, no doubt, their dedication to educating traders. Not a lot of brokers offer their services as well as an opportunity for everyone interested in the forex market to learn and grow.

Another significant comparison is the fact that Oanda is available to US clients. Many brokers shy away from this due to the many regulations involved in being accessible to the US. Still, the case is very different with Oanda, as they are licensed to operate in most states.

| Minimum Deposit | $50 |

|---|---|

| Demo Account | Yes |

| Currency Pairs | 80+ |

| Customer Support | 24/5 |

Forex trading carries a high level of risk and is not suitable for all investors. Past performance is not indicative of future results, and you should carefully consider your financial situation and risk tolerance before participating.

| Minimum Deposit | $0 |

|---|---|

| Demo Account | Yes |

| Currency Pairs | 70+ |

| Customer Support | 24/7 |

Forex trading carries a high level of risk and is not suitable for all investors. Past performance is not indicative of future results, and you should carefully consider your financial situation and risk tolerance before participating.

| Minimum Deposit | $250 |

|---|---|

| Demo Account | Yes |

| Currency Pairs | 80+ |

| Customer Support | 24/5 |

Forex trading carries a high level of risk and is not suitable for all investors. Past performance is not indicative of future results, and you should carefully consider your financial situation and risk tolerance before participating.

| Minimum Deposit | $5 |

|---|---|

| Demo Account | Yes |

| Currency Pairs | 70+ |

| Customer Support | 24/5 |

Forex trading carries a high level of risk and is not suitable for all investors. Past performance is not indicative of future results, and you should carefully consider your financial situation and risk tolerance before participating.

| Minimum Deposit | $100 |

|---|---|

| Demo Account | Yes |

| Currency | 100+ |

| Customer Support | 24/7 |

Forex trading carries a high level of risk and is not suitable for all investors. Past performance is not indicative of future results, and you should carefully consider your financial situation and risk tolerance before participating.

| Minimum Deposit | $250 |

|---|---|

| Demo Account | Yes |

| Currency Pairs | 80+ |

| Customer Support | 24/5 |

Forex trading carries a high level of risk and is not suitable for all investors. Past performance is not indicative of future results, and you should carefully consider your financial situation and risk tolerance before participating.